US Financial Services and secured loan companies file for protection from the US Bankruptcy Court Digital currencies BlockFi with eight of its subsidiaries. This is the last victim since its collapse FTX Earlier this month it caused a storm in the cryptocurrency market.

In its filing, New Jersey-based BlockFi said it owes money to more than 100,000 creditors, with liabilities and assets ranging from $1 billion to $10 billion. BlockFi’s largest creditor is Ankura Trust, which owes $729 million.

Read also: Billions of dollars in FTX scandal

The company had already stopped withdrawing customer deposits and admitted it had “significant exposure” to now-bankrupt cryptocurrency exchange FTX and its sister trading house Alameda Research.

Connect to the FTX exchange

Crypto exchange FTX is its second largest creditor, with a $275 million loan on a loan granted earlier this year. BlockFi — recently valued at $4.8 billion, according to PitchBook — is one of many crypto companies feeling the pressure of the FTX collapse. In July, FTX swooped in to help BlockFi avoid bankruptcy, extending a $400 million revolving credit facility and possibly offering to buy out BlockFi.

Read also: The “Cannonball” on FTX brings a deep winter to the cryptocurrency market

FTX breakdown

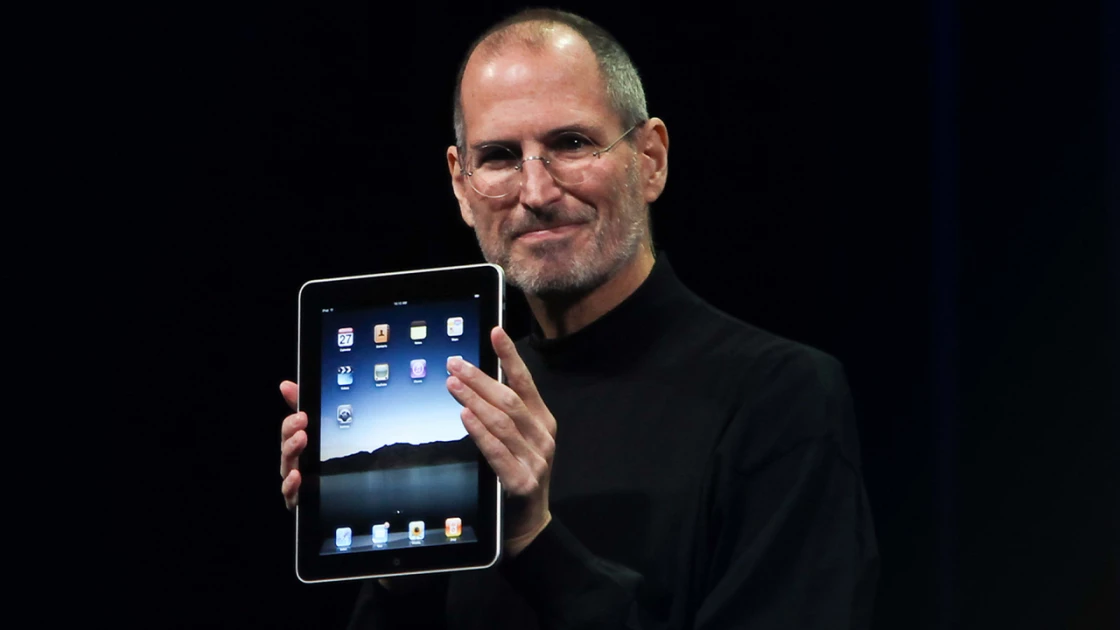

Sam Bankman-Fried cryptocurrency exchange FTX filed for bankruptcy protection on November 11, and the contagion effect across the crypto sector was swift.

About 130 additional affiliates are involved in the process, including Alameda Research, cryptocurrency exchange Bankman-Fried, and its US subsidiary FTX.us. FTX’s new CEO, John Ray, said in a bankruptcy filing that, “in his 40 years of legal and restructuring experience,” he had “never seen” such a complete failure of corporate controls and such a complete absence of reliable financial information as happened here.

source: OT.gr

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

Which brands have not sold a single new car in Greece?

The unknown trick – for just 1 euro you can make your car's windshield look like new

Two groups lay down “secret” rocket fuel.