Any sign of recession now could trigger a major sell-off…

Of particular concern are the signals they send Markets all over the world Especially the US stock market, according to the French bank Société Générale.

As he noted in a related briefing note, stocks are sending scary messages and any sign of a recession now could trigger a major sell-off.

Although US stocks are showing signs of resilience and strength… Bond yields, which have been rising rapidly as investors wait for further monetary policy tightening, may have a different, bleak future.

It should be noted that Fed interest rates are already at very high levels, ranging between 5.25% – 5.5%, US policymakers are considering further tightening while many market players are talking about increases of up to 7%.

Meanwhile, the US 10-year bond yield reached a 16-year high, rising to around 4.768%.

However, US stocks are resilient – and have been so all year.

Despite the heavy losses in August and September. Standard & Poor’s 500 It remains 10% above January levels.

Either way, bond yields could be a harbinger of pain to come.

Black Monday

The scene is reminiscent of the lead-up to Black Monday (1987), The Guardian reports Société Généralewhen stocks were resilient amid rising bond yields before the Dow Jones fell 22% in a single session, its largest decline in history.

On that day, eleven of the 30 Dow Jones stocks did not appear on the trading board at all in the first hour of trading, while more than a trillion shares were sold. Dollars from the stock market.

Dozens of American citizens lost their assets…while desperate investors committed suicide.

Then hysteria spread throughout the stock markets.

Major stock markets in Europe recorded significant losses, with the FTSE index in London falling by 7.85%.

In Paris, the CAC lost 9.04%.

In fact, in the period following the attacks of September 11, 2001 in the USA, the highest daily loss recorded in the Paris market was -7.39%.

Likewise, the DAX index showed a significant decline in Frankfurt, which showed losses of 7.07%, while the Amsterdam Stock Exchange also saw significant losses, as the main AEX index fell by 9.14%.

In Athens, the general index recorded significant losses of 5.85%, closing at 2,640.78 points.

“The resilience of the stock market in the face of rising bond yields is very reminiscent of the events of 1987, when the stock rally was finally stifled,” the French bank adds.

“Just like in 1987, any sign of recession could be devastating for stocks.”

However, there is increasing uncertainty about the path of the economy and expectations fluctuate throughout the year.

Although economists began to embrace the idea of a soft landing for the economy in mid-2023, rising bond yields clouded expectations.

“Never before have we seen such uncertainty about where we are in the economic cycle.

Société Générale adds: “Recession is still lurking or we are at the beginning of a new economic cycle.”

But the signs appeared.

www.bankingnews.gr

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

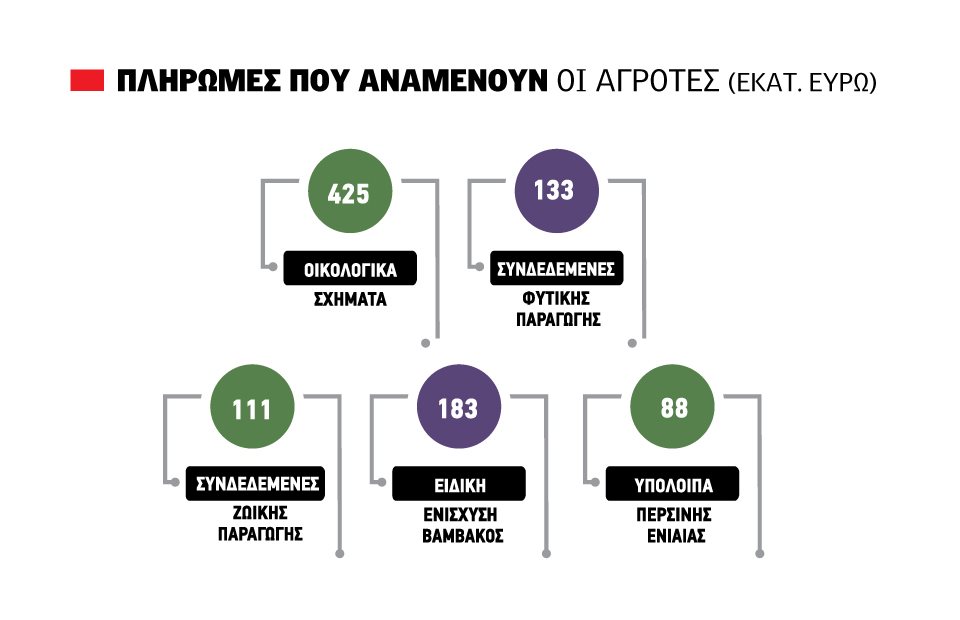

All Holy Week payments show the insufficiency of the farmers' “fund”.

Birth allowance: 36 million paid retroactively to 59 thousand mothers – beneficiaries

The European Union's “strike” on fast fashion giant Shein