![EFKA: Additions to old debts increase debt [πίνακας] – Financial postman](https://www.ot.gr/wp-content/uploads/2023/10/ot_efka1.png)

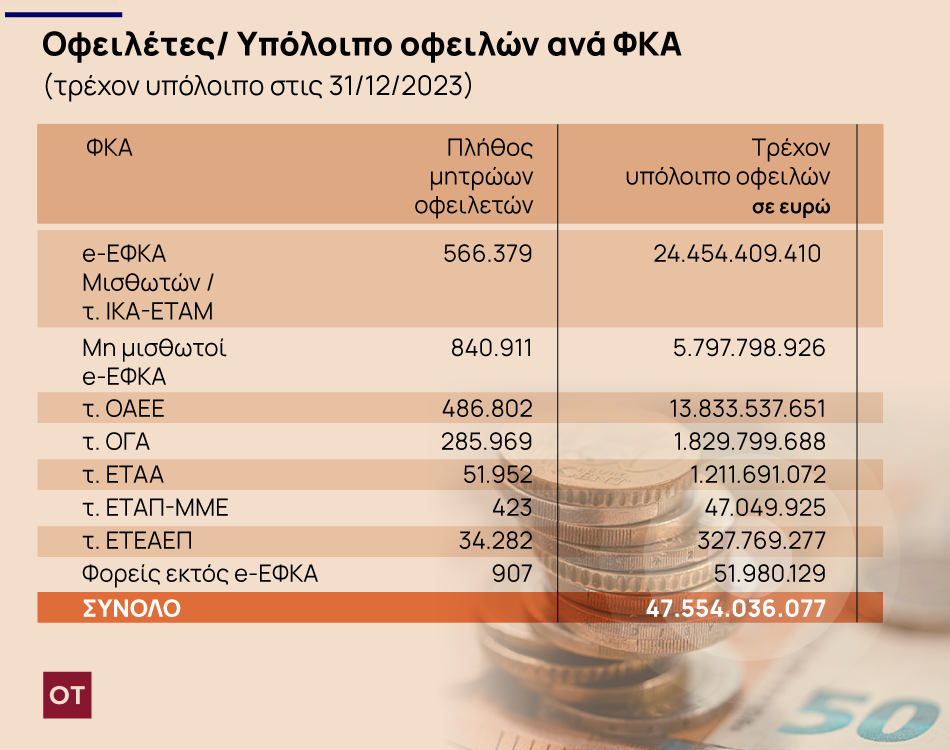

EFKA's debt continues to jump to new, unimaginable levels, reaching €47.55 billion, demonstrating the failure of most of the debt arrangements that have recently entered into force.

The growth in new debt comes from new and smaller debts, as older and larger debts are burdened by millions of dollars in additional fees and penalties.

Citizen Personal Number: When does the application start and what transactions does it include?

In the fourth quarter of 2023, the debts owed to the insurance fund increased by 385 million. The change concerns an increase of €403,433,965 in additional fees. At the same time, senior debt decreased by €18,368,644.

Debtors

Data from the Insurance Debt Collection Center (KEAO) report shows that there is a concentration of debtors at the bottom of the debt scales, with 1,711,819 debtors (75.49% of debtors) having debts of up to €15,000 each.

88.89% of debtors (2,015,803 debtors) have debts of up to EUR 30,000 each, while a large part of the debt balance concerns 95,057 debtors with debts between EUR 50,000 – 100,000 (14.05% of the current balance).

Most of the debts relate to a small number of large debtors with debts exceeding one million euros, with only 2,641 debtors collecting 23.67% of the remaining debts.

Notifications

As of the end of 2023, KEAO had sent debtors 2,186,156 second notices, while mandatory measures amounting to EUR 33.9 billion had been taken. The Center's services identify debtors who have not responded within 20 days of receipt of the individual notification to settle their debts, using each debtor's profile with information from the KEAO electronic system, the interface with the General Secretariat's register of information systems and GEMH data.

Specific criteria determine the degree of recoverability and risk of each debt. The age of the debt, as well as the point in time of its creation, is also examined in order to assess whether it was due to a financial crisis or systemic insolvency of the debtor.

These are increasingly due to older debt, where surcharges and surcharges are pushing the total higher, rather than new debt, where evidence shows that prime debt is falling.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

“Currency” and “Bulletin” – what do the symbols we all see on our mobile phones mean?

Child Benefit: Notice to Beneficiaries

A unique piece of uncut diamond