Sometimes it seems like billionaires can control our lives – or at least the news. However, the ambiguity in US tax data suggests that at least one ultra-wealthy person has flown under the radar until the very end. In other words, he died without anyone realizing it.

the the daily reports The US Treasury’s government financial transactions revealed a surprising data point on February 28, 2023, according to Quars: the $7 billion deposit in the “inheritance and gifts” tax category. This was the highest collection of this type of tax since at least 2005. It’s possible that more than one huge tax bill was processed that day, but even that would be great.

an actress Ministry of Finance She says it wasn’t a reporting error, and her rep Internal Revenue Service It is unlikely, he says, that the reason for this is to process the amount of revenue in one day. Privacy rules prevent government officials from discussing the details of any tax return.

How do inheritance and gift taxes work?

John Rico, associate director of budget analysis at Penn Wharton’s Budget Model, a University of Pennsylvania group that tracks the effects of changes in economic policy, discovered the massive tax refund for the first time. Rico has been tracking inheritance tax filings because of an odd natural experiment: Although the estate tax was cut in 2017 during President Donald Trump’s tax reform, collections have skyrocketed in recent years, likely due to excess deaths of seniors during the pandemic.

But even the high incomes of recent years pale in comparison to the current fiscal year. The U.S. government collected nearly $8 billion more in inheritance and gift taxes in the fiscal year that began in January last October compared to 2022.

Another surprise is that the two potential sources of payment, endowment and inheritance taxes, can be significantly reduced through the type of strategic planning commonly used by wealthy individuals. After amending the 2017 law, real estate was taxed at 40%, but there are significant exemptions. For example, the first $11.58 million of real estate is tax-exempt, and the estate can take advantage of flexible rules for valuation of private companies. Tax payments can also be reduced by setting up trusts and charities to protect income from taxes.

Based on the tax rate, that $7 billion would mean an estate or gift of about $17.5 billion. But the Tax Policy Center, a Washington think tank, estimated that real estate typically pays an effective tax rate of 17 percent after exemptions and other forms of evasion. Even if only 50% of the estate is taxable, that would mean its potential value is $35 billion. Even a lower estimate would make the property owner one of the 100 richest people in the world, according to Bloomberg News.

Where does this money come from?

the Gabriel Zuckmaneconomical in Berkeley Universitywhose work has focused on tax policy and the wealthy, says there are some plausible hypotheses: “Someone very rich who was not discovered by Forbes, a big gift, a late payment from some billionaire who died several years ago.” [πριν] (possibly as a result of law enforcement efforts).” The gift tax may also be levied by divorces involving non-US spouses, but payments within one year of the divorce are generally exempt.

The deposit may be the result of a different kind of advance planning: Anyone with significant wealth can make a taxable gift now to avoid future inheritance taxes on the entire net worth, says Ray Madoff, a professor of tax law at Boston College. worth. For example, one could give $17.5 billion to an heir and Pay 40% of the $7 billion gift tax. This should save him money in the long run because if he died with an estate worth $24.5 billion, he would need to pay about $9.8 billion in inheritance taxes.

the Standard submission deadline For inheritance tax, it’s nine months after death, although it can be extended for another six months – a later legal dispute with the tax office can add more time.

Forbes, which makes efforts to track net worths that rely on public assets or the often questionable collaboration of the rich person in question, doesn’t provide a clear answer to the question of whose estate paid such a large amount of tax. The publication’s list of billionaires who died in 2022 does not include any Americans with great fortunes. Non-US citizens can be subject to inheritance taxes if they hold US assets in their name, but it would be unusual for a foreigner to have investments of this size without sophisticated planning..

Forbes list 2021 reports Sheldon Adelson passed away in January 2021 – the casino mogul’s fortune is estimated at $35 billion. That’s about the right size, but if ProPublica doesn’t have the answer in its trove of leaked IRS data, we may never know.

All news

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

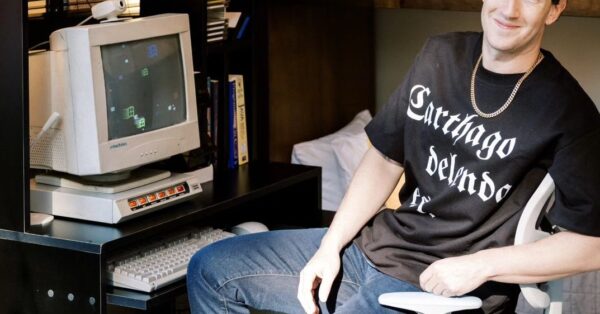

Mark Zuckerberg: Rare photos with his three daughters on the occasion of his fortieth birthday | Marie Claire

Didi: It is necessary to identify mobile network users

International Monetary Fund: Artificial Intelligence will hit the labor market “like a tsunami”