Delete Debts And selective settings for thousands of medium and large companies Debtors With debts from 100,000 to 1 million euros he counts Ministry of National Economy and Finance By order of Prime Minister Kyriakos Mitsotakis. The aim is to increase the collection of overdue debts by up to 106 billion euros, which will give plenty of breathing room to state coffers at a time when the cost of damage from the catastrophic floods in Thessaly and the fires on the Evros River is mounting. Dimensions.

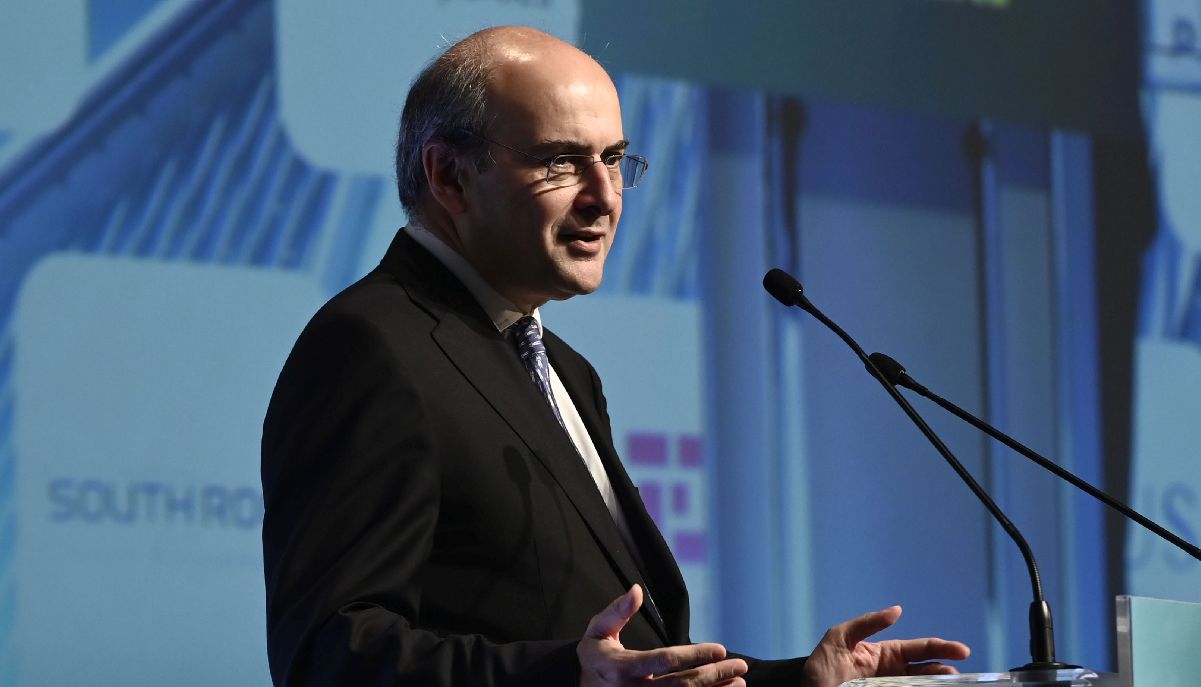

According to the blue envelope, handed over by Kyriakos Mitsotakis to Kostis Hatzidakis, finding personal sustainable arrangements for 43,125 individuals and legal entities with “red” tax debts of more than €270,000 each is a central priority for 2024.

At the same time, the scenario of applying a flexible regulation to 9,198 debtors who owe more than a million will be studied. EUR each and a total of EUR 81.9 billion As in this category of debt, that is, from EUR 1 million to EUR 100 million, there is a significant increase in debt of EUR 1.1 billion and there is already a warning from AADE.

Another impressive element is that it is within this debt that the bulk of the debt is collected which amounts to 77.3% and comes from 0.2% of debtors. Conversely, 72.9% of debtors are concentrated in debts between 50 and 10,000 euros, which constitutes 3.7% of total debts. From the processing of the Budget Office data in the House of Representatives, it appears that the small debtors are the ones trying to close any pending cases they have with the Tax Office, while the adults blow the whistle carelessly. It is notable that the highest percentage of repaid debts, at 24.3%, is found among taxpayers whose debts range from 500 to 10,000 euros. Conversely, we find lower debt settlement rates for debts in the category above €150,000.

The Ministry of National Economy’s work plan for 2024 also stipulates liquidating the list of overdue debts at the Tax Office by deleting those that are considered uncollectible in order to obtain a complete and true picture of the size of the red debts and the number of outstanding debts. Debtors. According to AADE data, of the total debt of 105.7 billion euros in taxes and fines, 26.3 billion euros cannot be collected because they come from bankrupt companies and debtors who have no income or movable and immovable property. The procedures to be followed to finally classify a debt as uncollectible will be strict and in accordance with the General Revenue Collection Act.

Specifically, in order to remove a debt from the AADE list, you must:

1. Investigations were completed, relying on electronic means available to the tax administration, to ensure that there were no assets of the debtor, joint obligations, or claims towards others.

2. It is proven that the process of forced execution on the debtor’s movable and immovable property or his claims has been completed, with the state or third parties accelerating the liquidation procedure and stopping bankruptcy procedures if it is bankruptcy. .

3. The audit is carried out by an auditor specially appointed by the competent tax or customs authority, who certifies, based on a specially justified audit report, that the conditions of the preceding cases are met and that it is objectively impossible to collect the funds. Debts.

4. The request for criminal prosecution must have been submitted in all cases in which the legal conditions were met or if it was not possible to submit it.

5. Regarding the debts of companies subject to state control that are under liquidation or bankruptcy, these procedures require a state declaration.

Based on AADE data in the eleven months from January to November 2023, 3.97 million individuals and legal entities had open accounts with the Tax Office, while mandatory collection measures had already been taken for 1.487 million.

In more detail, the debt moves that will be taken in 2024 to reduce fees are as follows:

Creating sustainable personal arrangements with a focus on medium and large debts,

Centralize the management of procedures for the forced collection of tax and insurance debts to the state.

Corporate restructuring and avoiding bankruptcy for those companies that can be saved.

Monitor existing agency arrangements

Protecting the interests of the state in a timely manner.

Divide debts into collectible and uncollectible.

Liquidate old debts by creating and implementing a new debt cancellation framework.

Follow Powergame.gr on Google News for instant and valid financial information!

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

Banning the sale of old used cars – what's changing?

With reductions in electricity tariffs – Newsbomb – News

Are you okay when you tell us we're okay?