The holidays are over and everything points to us entering the hottest quarter the market has seen in many years. A period capable of high interest in the stock market. I am not only referring to the fact that we are entering the last mile of the investment phase, nor to the resumption of major projects and investments undertaken by the Rapid Response Fund. I am referring to the element that brings intense development planning, the euphoria of new project contracts and strong fundamentals that have given the green light to the emergence of large aggressive expansionist movements and agreements of millions, not to mention billion or two billion euro cases. Four of the most common cases of listed companies that predict us a warm autumn with the realization of important deals are TERNA Energy (TENERG), Profile (PROF), MIG (МИГ), and Euroconsultants (ESYMB).

I’ll start with her Introductory account, Which throughout the summer concluded new contracts for the implementation of projects not only in the domestic market, but also in the international market, which led to an increasing backlog of projects both in the financial sector and in the digital transformation of public institutions and organizations. In fact, there are so many new project assignments that the group will announce one almost every week. This also happened last Thursday with the announcement of the assignment of the new project to FundBank, based in the Cayman Islands. Be careful here, because the “press” done by Profile in the fast-growing Caribbean region can bring projects worth more than 20 million euros. This number starts from here, as the group has a strong presence in more than 48 countries. Meanwhile, Profile is ready to announce its presence in the new global trend of artificial intelligence (AI). However, what will give a leap forward in the size of the group is the new major acquisition that the management is preparing, which is now in a very mature stage. In the stock chart analysis, it seems that the first target is closed at EUR 5.40, while immediately after that the way will be opened to EUR 6.80.

I proceed Terna EnergyWhich may have recently been “affected” by the stock’s short-term movements due to the restructuring of the MSCI indices, but it did not stop for a minute to be at the top of the attention of powerful investment schemes and large companies that set ambitious goals in the energy sector transformation. They know, after all, that with the TERNA Energy acquisition, new financial footprint data will lead to strong setbacks in mega fund stakes that will come after the investment phase. It is heard in the various current market communication “channels” that if First Sentier does not place the final signature, a giant sovereign investment fund and a well-known energy group will sit directly at the table, if they have not already. Graphically, the stock is now depicted as a potential buying opportunity around the strong support area of €16.10 to €15.85, with the initial target set at €20.

the Euro Advisors They are frantically preparing to make not one, not two, but three acquisitions. In fact, the company is in very advanced discussions and close to the final stage with two of them, one of which is active in the field of consulting services and has extensive experience in international projects and the other in business process outsourcing. As for the third company that works in the field of health and safety consulting services, exploratory communications have already begun. Completing acquisitions will fundamentally change the company’s image, actually increasing its size and profitability. Meanwhile, the management, which has an impressive €2 million fund, which is expected to be further strengthened by the sale of the property, is considering a significant bonus for its shareholders. In the chart analysis, the stock has conquered the 1 space and is now looking at 1.20 to 1.30 euros.

I conclude with a complete refurbishment of the MIG. So the company, which has no debt, 90 million euros from the positive impact of the sale of Attica and 13.3 million euros in cash, is now free of “burdens” to chart a new course. Piraeus Bank, which controls 88%, has invested more than €144 million in MIG in recent years. Its options are either to give the subsidiary new funds, so that it can develop an investment activity that will bring it a good return in the future, or, according to some insiders, to use it as a “vehicle” to enter the Greek Stock Exchange for another company. In fact, in the last piece, despite any denials, the name SKY Express of Mr. Yannis Grillo was heard. The entry of Sky Express, in combination with Athens International Airport and the Aegean Sea, would certainly create a very strong foundation for tourism investment. The newly enlightened stock needs special attention with the upside split of €4.40, as it will target €5.30.

* Apostolos Manthos is responsible for technical analysis and investment strategy

*Republished from Kivalio newspaper

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

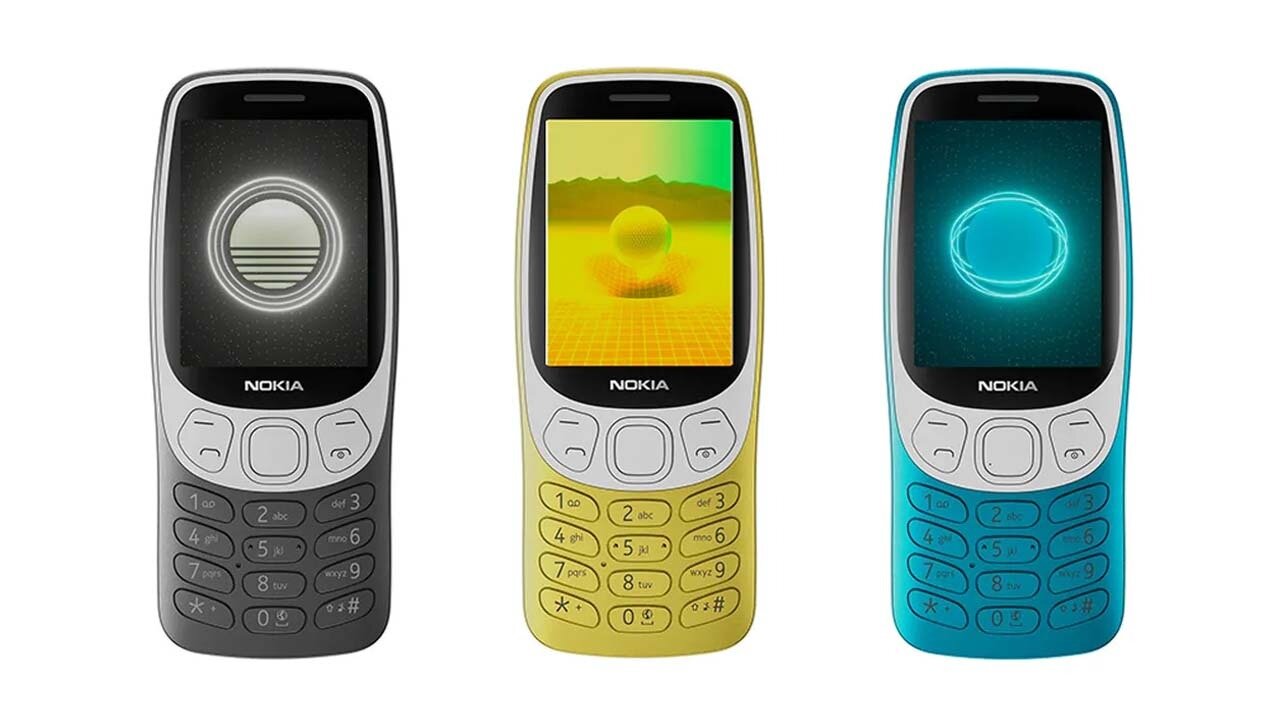

“Currency” and “Bulletin” – what do the symbols we all see on our mobile phones mean?

Child Benefit: Notice to Beneficiaries

A unique piece of uncut diamond