The numbers are already baked in and will appear over the next 24 months.

by Wolf Richter to Wolf Street.

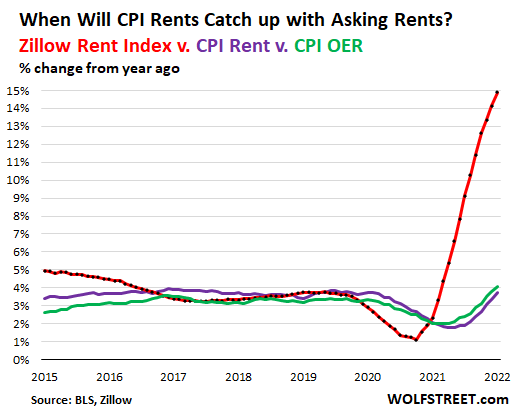

The rent factor represents 32% of the CPI. Despite the massive rise in “rent demand” across the United States, these two rent factors for the CPI have been much lower than the CPI and thus have held back the CPI so far. In contrast to rent demand, these two rent factors track the average rent actually paid by tenants across the entire inventory of rental units in US cities, including rent-controlled units.

On the other hand, “Rental Demand” reflects the current price tags of the units listed for rent that people have not yet rented, and it takes some time for people to rent out these units and pay these rents in large enough numbers to where they are moving. of the average rent actually paid across the entire stock of rental units in the United States, which is then captured by CPI rental metrics.

But these two factors in rent to CPI will have to catch up with rent demand and will then increase the overall CPI- which was already 7.5% in January, WHOOSH.

But when will an increase in rent demand cause the CPI to rise? How much will it add to the consumer price index?

The short answer: Current increases in rent demand that have already occurred through January 2022 will add more than one percentage point to the total CPI for 2022, and will add more than one percentage point to the total CPI in 2023, even if demand rents do not rise further. from here. This is already baked in the numbers. CPI will catch up with a painful reality that will spread over the next two years.

Lease demand spikes are brutal.

Rents for single-family homes and condos in the rental market are up 12% year-over-year in the United States, varying widely from city to city, the worst increase in data starting in 2004, according to CoreLogic today. Miami was at the top of the list, with rents up 35%. In the years between the financial crisis and the pandemic, rents for single-family homes in the United States were increasing in the 2.5% to 3.5% range.

Apartment rents — not including single-family homes and condos for rent — jumped 12% for one-bedroom apartments and 14% for two-bedroom apartments, on average across the United States, according to Zamper data. In 20 of the 100 largest cities, rents increased by 20% or moreIn 11 of them, rents increased by 25% or more. This is based on average rental demand, which is an advertisement for rents by landlords for their listings. They are like price tags in a store.

By a different measure, the Zillow Observed Index of Rents, January rents rose 14.9% year over year across the US, varying widely between cities.

All of these metrics show the same thing: On average, rents across the US are up more than 12% year-over-year, and vary wildly from city to city, with some cities seeing astronomical increases in rents.

Rent demand takes 24 months to spread through CPI rent inflation.

Asking rents are the current prices. They don’t show up in rent inflation until enough people sign leases for units at those rents, and actually pay those rents in large enough numbers to move the needle of the entire stock of rental units in US cities.

This makes rental demand a leading indicator of CPI rent inflation. It turns out, according to a study conducted by the Federal Reserve Bank of San Francisco, that this demand for rents is increasing It has already happened It will push CPI rent inflation higher over the next 24 months.

the Two measures of rents in the CPI which together account for 32% of the total CPI show this lag, although they are also starting to rise. CPI’s primary residence rent (“CPI rent”) in January increased 3.8% year over year, and CPI’s owner’s rent equivalent (“CPI OER”) increased 4.1%.

These two CPI measures track what renters actually pay in rent across the entire inventory of rental units in cities. This includes tenants in rent-controlled apartments where rents do not rise sharply, includes tenants with active leases where rents cannot be increased, and includes tenants whose landlords are slow to raise rents for a variety of reasons, including retaining good tenants.

Therefore, CPI measures will not rise with the same volume of rental demand. Between 2017 and 2019, CPI metrics were closely tracked with the Zillow Index. But in 2015 and 2016, there were significant differences: in January 2015, the Zillow Index showed rent increases of 5%, while CPI measures showed rent increases of 2.6% and 3.5%.

When will rent demand start feeding into the overall CPI?

So far, the rent factors in its CPI repressed The general index of consumer prices. January’s overall CPI jumped 7.5%, despite of The lower readings of the rent factors – principal dwelling rent (3.8%) and owner’s equivalent rent (4.1%).

The San Francisco Fed has now come out with Staff Report To estimate when rental requests will filter into the CPI rent metrics, and thus into the overall CPI. This will happen over the next 24 months little by little.

The rents that have already occurred are likely to raise the CPI rent factor by 3.4 percentage points in 2022 and then again in 2023, and given the weight of 32% of the rent factors, you would add 1.1 percentage points to whatever CPI would be through the end of 2022 and will add 1.1 percentage points to the total CPI in 2023, even if there are no further increases in market rents.

So any stabilization or even a fall in CPIs for new and used vehicles will be diminished, due to their much smaller weight, compared to the upcoming increase in CPI rent factors.

In terms of measurement The Federal Reserve uses as an inflation target, “essential personal consumption expenditures” whose residential components are smaller than they are in the CPI, the required rent increases that have already occurred will add 0.5 percentage points to core personal consumption expenditures in both 2022 and 2023, according to the Federal Reserve Board in San Francisco, even if there are no further increases In the market rent.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

Used Car Travels Around The World – Crashed, Sold For New Car

If it weren’t for the merger of Attica Bank and Bankritia, they could have collapsed.

Debt: When will it return to 60% of GDP – “Snowball” Stournara and the Greek Bell