Even before the collapse of Silicon Valley Bank of America (SVB) and the signature bank and the subsequent hasty agreement to take over Swiss credit from UPSdepositors in the euro area began to reduce deposits On it because interest rates are disappointing despite the sharp increase in borrowing costs from the European Central Bank (ECB). According to official European Central Bank data, depositors from banks in the 20 member states of the eurozone have withdrawn about 214 billion euros over the past five months.

More specifically, overnight deposits shrank by €140 billion in February, reflecting a record high and thus reversing the large wave of savings that occurred during the pandemic. At the same time, two-year deposits increased by 83%. euros last month. There is also a preference for money market mutual funds. In particular, yields on short-term government bonds are particularly attractive, with the two-year German bund yield boosting from around 1.5% in late September to 2.57% on Tuesday.

In March, a crisis of confidence erupted in regional US banks, as depositors withdrew tens of billions of dollars in uninsured deposits. The root of the problem lies in doubts about the adequacy of capital following the losses incurred by bank portfolios from the sharp drop in bond prices caused by the sharp rise in interest rates to their highest levels in recent years on both sides of the Atlantic.

But the outflow of deposits in the eurozone for months reflected the difficulty faced by banks in attracting capital because the rise in interest rates on deposits was not satisfactory. As reported by the Financial Times and research firm Raisin, Germany’s highest interest rate on direct deposits is limited to 1.6% compared to the 3% deposit acceptance rate of the European Central Bank.

However, it should be noted that withdrawals made in the five months ending in October correspond to 1.5% of total deposits, a total of $14 trillion. euro. It is less than the $500 billion decline in US deposits over the past 12 months. Withdrawals from corporate clients have also been recorded by the Bank of England. It was £20.3 billion in January, setting another record.

Much of the money withdrawn from deposits has been channeled into investment products that may not be immediately liquid but yield higher returns. The British newspaper indicates that this trend is due to the ability of banks to collect 155 billion euros from issuing bonds, two-thirds of which are long-term securities. At the same time, a decline in credit expansion was noted after a five-year growth. Analysts predict that the recent turmoil in the banking industry is expected to make financial institutions more conservative in lending.

Follow Powergame.gr on Google News to get instant and valid financial information!

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

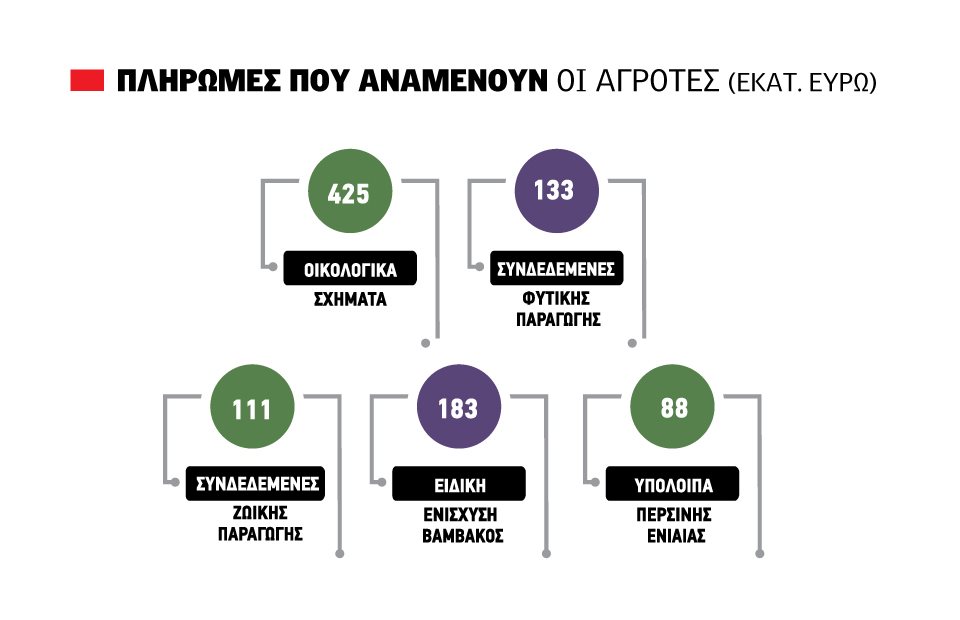

All Holy Week payments show the insufficiency of the farmers' “fund”.

Birth allowance: 36 million paid retroactively to 59 thousand mothers – beneficiaries

The European Union's “strike” on fast fashion giant Shein