Details of the allowance for vulnerable consumers are set out by the Department of Energy and Environment.

The Ministry of Energy and Environment published 10 questions and answers related to the amount of the allowance, who will receive it, how to apply, and who will be excluded.

1. Who are the beneficiaries of emergency aid?

The number of beneficiaries is estimated at approximately 1.2 million, and they are those who cumulatively meet the following income and ownership criteria:

a) Family income for individuals 16,000 euros, married 24,000 euros, with an increase of 5,000 euros for each dependent child,

b) Business turnover up to €80,000 (only for self-employed people) and

c) Property value of up to €200,000 for individuals and up to €300,000 for married or single-parent families.

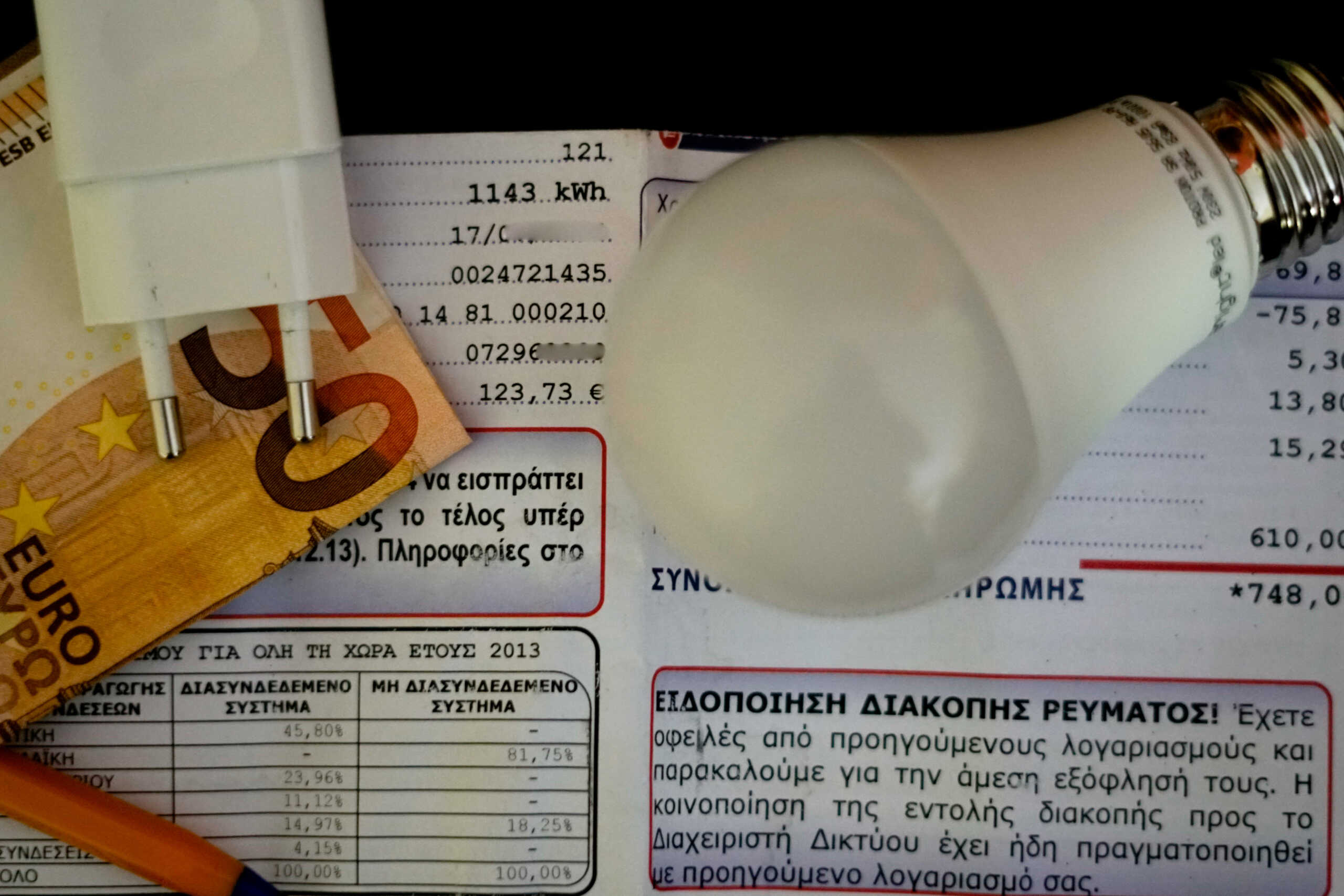

2. What is the amount of emergency assistance and how is it calculated?

The amount of emergency assistance per month will be up to 60 euros over the days of class per settlement.

Due to increased energy needs in settlements with extreme cold (day degree factor more than one), the calculated amount of aid is increased by 25% for beneficiaries living there and cannot exceed 160 EUR per month and 480 EUR respectively on a quarterly basis at most. Based on the above, the range of aid for three months ranges from 45 to 480 euros.

3. Does the square footage of my home affect the assistance amount?

No, the square footage of a beneficiary’s home is not a criterion in calculating emergency energy assistance for vulnerable consumers.

4. Can I get Exceptional Assistance if I already receive a heating allowance for oil, natural gas, or other forms of heating?

Excluded from exceptional aid are beneficiaries of a grant for heating with oil, natural gas, and other forms of heating for the winter season 2023/2024. In addition, those on the social tariff will be excluded, who will continue to receive support through their electricity bills.

5. How do I apply for Electric Emergency Heating Assistance?

Applications are submitted through AADE’s ‘myHeating’ platform, where requests for inclusion in the Emergency Assistance Register will be submitted. It should be noted that each family can submit one application to register the provision number of its main residence.

6. What information must be included in an application for emergency heating assistance?

The application must include, as the case may be, the following information:

a) Tax registration number (TFM) of the requesting person – taking into account the tax return,

b) his name,

c) The number of his dependent children,

d) The electricity supply number for the main residential property,

e) the postal address corresponding to the specified electricity supply, if the dwelling is privately owned, rented or free-granted, in addition to the leased or free-granted AFM,

f) The tax number of the person to whom the electricity bill was issued, the VAT number and the name of the supplier who issued the last available bill and

g) His contact data (email address, mobile number or landline number).

After checking the income and asset criteria by AADE, details of the beneficiary’s VAT number, the invoice’s VAT number, the supplier’s VAT number and name, the electricity supply number of the main residence and the subsidy amount due are displayed. They are sent to DEDDIE, so you can deliver them to suppliers and apply support to invoices in the form of a discount.

7. Who submits a request for emergency assistance?

The allowance is granted at the household level and the application is submitted by the person responsible for filing the income tax return or by one of them in the case of filing a separate return.

8. How will the subsidy be applied to electricity bills?

The discount will be applied to electricity bills (against or settlement) related to the support period (January 1 – March 31, 2024).

If the account includes a period of the month, the monthly support is distributed in proportion to the days of the month in question, within the support period.

9. Do I have to provide any proof of the electricity consumption bill in the “My Documents” application?

The beneficiary – the electricity consumer must enter the required details for electricity bills on the platform.

To register account details, the electricity bill number, total amount/bill value, tax registration number (TIN), supplier name and VAT number of the beneficiary to whom the bill was issued must provide the electricity supply number shown on the invoice and must correspond to the main residential supply number declared during the order and the consumption period for which Covered by the electricity bill.

It is noteworthy that invoices related to the consumption period from January 1, 2024 to March 31, 2024 are taken into account, and the total amount of spending must be published on the platform.

10. Can I provide proof of electricity consumption for the gradual support period?

Details of expenses resulting from accounts related to the support period can be provided gradually, when the relevant account is issued. In all cases, the beneficiary will be able to submit, until September 15, 2024, data on all invoices issued in his favor and related to consumption during the assistance period.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

)

More Stories

Are you okay when you tell us we're okay?

A new wave of retirement journeys – we will reach a record high in 2024 with more than 212,000 retirements – a ceiling of €400 million

Thieves' new trick: This is how they steal from drivers on the national highway