Difficult times begin now for her American economic dominanceas the decline in the dollar that was symbolic of the strength of the dollar has already taken effect United States of America.

the Janet Yellen he exclaimed proudly 2017 that drWe will not witness a new financial crisis, and a crisis came in the repurchase market, and the extraordinary measures that the US Treasury had to take and print trillions of dollars by the Federal Reserve In order to deal with the economic consequences of the lockdowns imposed to deal with the public health crisis caused by COVID-19.

In response to a request to comment on the rise in international non-dollar trade around the world since the start of US sanctions, she said:I don’t think the dollar is facing serious competition and it’s not likely to happen for a long time.”

The reason for openly challenging the dollar’s supremacy – as reported by Reuters in its related analysis – It goes back to the international sanctions imposed by the Western alliance on Russia Led by the United States, it is beginning to erode the dollar’s decades-long dominance in international oil trade as most deals with India – Russia’s largest oil market – are now de facto settled in other currencies.

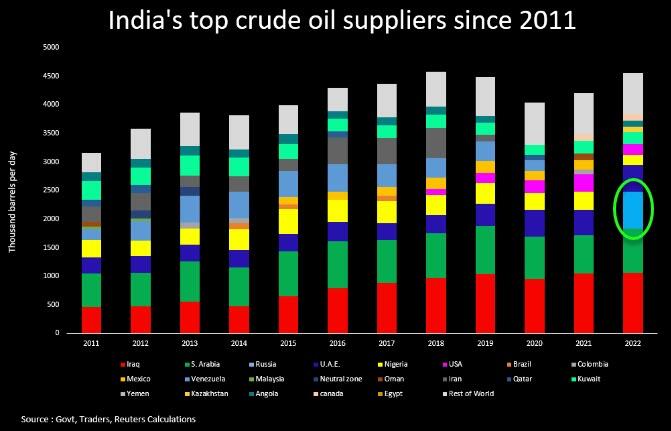

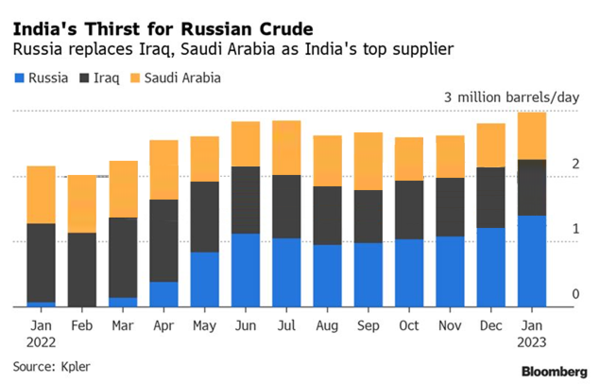

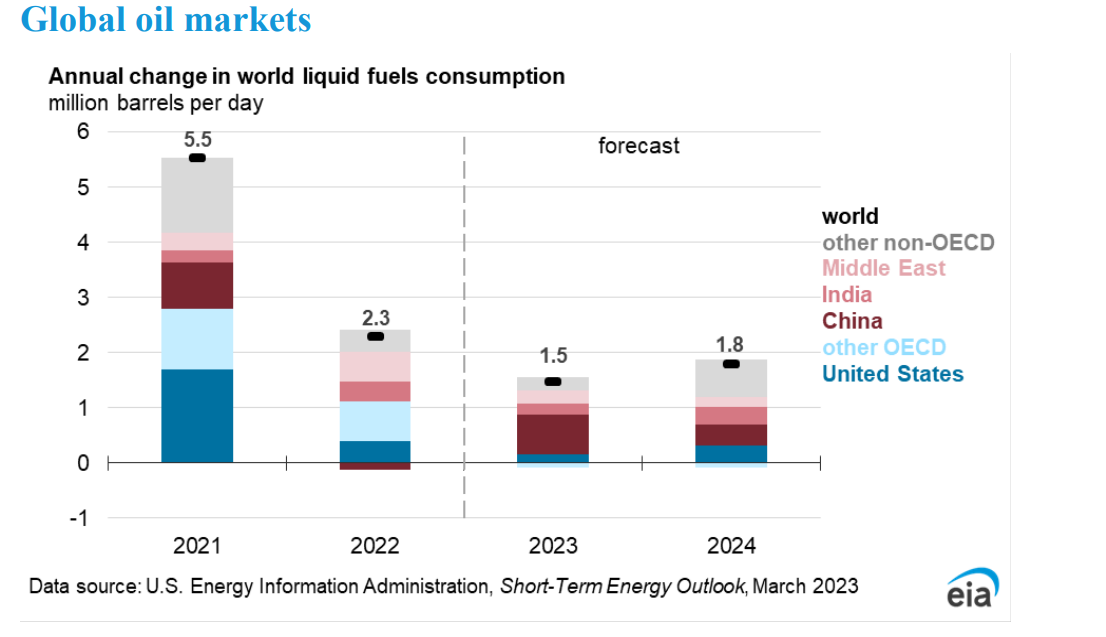

India eIt is the third largest oil importer in the world and Russia has become its main supplier After Europe cut off the supply of energy products to Moscow following its invasion of Ukraine that began in February last year.

As Reuters notes, since then The Western alliance imposed a ceiling on oil prices in Russia As of December 5, Indian customers have paid for most of Russia’s oil in currencies other than dollars, including UAE dirhams and more recently Russian rubles, according to multiple trade and banking sources.

The most amazing thing is thatThe agency sources added that the total transactions over the past three months amounted to several hundred million dollars,

We recall that the Deputy Managing Director of the International Monetary Fund, Gita Gopinath, said in the month following the Russian invasion of Ukraine thatSanctions against Russia could erode the dollar’s dominance by encouraging smaller trading blocs to use other currencies.

“Even in this landscape, the dollar will remain the most important global currency, but fragmentation at a smaller level is certainly very likely,” he told the Financial Times.

In addition, outside of Russia, Tensions between China and the West are also eroding the long-term rules of global trade that have supported the dollar.

The dispute with Saudi Arabia

Mainly an important part of thisThe monetary system and the hegemony of America of course, Depends on the petrodollar. Payment of US dollars for the worldwide trade and sale of oil by Saudi Arabia and other members of the Organization of the Petroleum Exporting Countries (OPEC) – After the agreement concluded between them Washington and Riyadh in 1974. Coincidentally just three years after Nixon removed the dollar of the gold standard.

This agreement not only secured the kingdom’s military defense under a security doctrine through American guarantees, but also ensured a steady flow of foreign purchases of US treasury bonds and debt – m.A strategy to recycle petrodollars to Washington – through the foreign exchange reserves of the Gulf state.

This steady stream has successfully led to an influx of more central bank reserves, fueled by the subsequent success of the dollar and increased global confidence in its stability.

He was The main success story of the current monetary system.

important transitions

So when it was revealed last year that Saudi Arabia was considering marking the sale of its oil to China in yuan, it was no small change in the global monetary system.

Many analysts at the time –overwhelmingly pro-Western – and dismissed it as a mere symbolic gesture, pressure tactic on the United States, or sending a political message.

Almost a year later, the kingdom appears to be serious about these potential intentions.

in Davos in January, Finance Minister Mohammed Al-Jadaan It revealed Riyadh’s willingness to trade not only in the yuan, but also in a variety of other currencies.

the Kingdom of Saudi Arabia It was not the only country, like other important allies of the United States, andThat India, Pakistan and the UAE have also entered into agreements with Russia or China to buy oil or other commodities in their various local currencies.

the Iraq It was the latest move away from the dollar’s dominance, as it announced this month that it plans to conduct foreign trade directly from China in yuan.

Decentralization of the global monetary system

The decisions these countries made — with many more to be added soon — represented a major shift toward a more decentralized global monetary system away from, in the first place, the dollar. Because of a miscalculation on the part of Washington regarding its harsh sanctions against Russia at the beginning of Moscow’s special military operation in Ukraine.

The United States appears to have dealt a devastating blow to its currency by cutting Russia off from the SWIFT payment system and freezing more than $350 billion of its gold and foreign exchange reserves.

On the other hand, this measure alone has significantly lowered confidence in the dollar-based monetary system among many countries, especially those. Global South Who have long questioned the hegemony of the United States, which led to More question the feasibility and retention of their reserves in the mighty dollar.

Geopolitical changes and the monetary system

This is exactly why the Ukraine war is such a central issue — it is a gamble the United States is willing to take To re-insure the value of the dollar, and to be able to restore confidence in it as a stable currency, it deserves to remain the dominant reserve currency in the world.

This is true if Ukraine wins and there is a Russian defeat.

If tKyiv loses, Moscow wins, However, this could mean a further decline in the dollar’s strength.

There is one main reason why emailMuch depends on the outcome of the war in Ukraine.

Switch to BRICS

In this equation, Saudi Arabia does not intend to rely on the outcome of the war to determine its foreign and economic policy.

He insists on maintaining excellent relations with the United States While it simultaneously expands its relations with Russia, China and other powers to the east, it will continue to trade largely in dollars for the foreseeable future. But at the same time it would be open to accepting other currencies when conducting bilateral transactions, even if this was clearly detrimental to US hegemony and a violation of the agreement made with Washington all those decades ago regarding the petrodollar.

Kingdom’s interest in joining the brix – The economic bloc consisting of Brazil, Russia, India, China and South Africa – part of this new trend to form a new bloc that includes Iran, Turkey, Algeria and Egypt also aims to join the group.

Rather than being an exclusive club of the fastest growing economies in the developing world, they see BRICS as an opportunity for the countries in it. The Global South to come together either to challenge the dominance of the dollar or to secure a better negotiating position.

Since the discussion on the expansion of the bloc will take place this year, the BRICS countries are scheduled to make a decision soon on the possible admission of these countries.

if Saudi Arabia accepted and approved itas a major blow to the dollar and ending the recycling of petrodollars in US debts, as the Kingdom deepens economic relations with great powers such as China and India.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

5 Easter desserts that will wow your guests

Bloomberg: Europe's largest “smart city” is being built in Greece

Strong fall in the wall, due to deteriorating bonds – at -1.57%, S&P 500, Nasdaq -2%