the Lagarde’s first blunder It came early in her tenure at the ECB, and cost Italy billions and the ECB a great deal of its “credibility” as a backstop for the fragile euro that Mario Draghi, Lagarde’s predecessor, had worked so hard to secure.

It was March 2020. And under the stress that those days were causing Economic heart attack due to the pandemicFinancial markets were in a state of panic, especially regarding the solvency of Italy, a country with massive debt without its own central bank to print money in the manner of the US Federal Reserve, the Bank of Japan, and even the Bank of Japan. England.

When asked at a scheduled press conference whether the ECB would support Italy’s debt to narrow interest rate spreads (the difference in borrowing costs between member state governments) within the eurozone, Lagarde was quick to repeat Draghi’s famous promise that he would do “whatever it takes.” . instead of, He did exactly the oppositestating: “We are not here to close spreads.”. Within seconds, Italy’s debt servicing costs, both private and public, skyrocketed. Under Draghi, the Italian government suddenly found itself in a state of apoplexy. Only Georgia Meloni, the far-right who has since ascended to the prime minister’s office, was enthusiastic.

The second blunder was less resonant, but its effects were deeper and longer-lasting. Since the crash of 2008, the European Central Bank has been sending newly minted euros to fragile European banks in the hope that they will lend them to companies – especially small and medium-sized ones – and thus revive the faltering European economy. When interest rates were official NegativelyThe ECB was effectively paying bankers to accept hundreds of billions of euros into their accounts at the ECB. Instead of lending this money to small and medium-sized enterprises, they kept it in their accounts at the European Central Bank They keep collecting The amounts paid to them by the European Central Bank in the form of negative interest rates.

As inflation returned strongly, and interest rates became positive and high, the same bankers kept their depositors’ billions of euros in their accounts with the European Central Bank to collect the high interest rates, while continuing to pay their depositors a small amount. interest. And Lagard? How did he react to this immortal alisverisi? Instead of using the powers of the ECB to put god-hating bankers in their place, it turned a blind eye, leaving them free to parasitically enrich themselves, especially at the expense of small and medium-sized companies.

Once again, Lagarde’s ECB has given the far right a huge gift. In Italy in particular, where perennially stupid Eurozone policies have brought the far right into government, the bankers’ extravagance tempered by the ECB has given Meloni the impetus to capitalize politically by imposing an extraordinary tax on bankers, thus posing as a protector of the weak. – Traction gift for neo-fascists. As if this was not enough, Lagarde and the European Central Bank reacted to this reasonable tax Take the part From…bankers. I cannot imagine a more effective way to enhance the appeal of the far right in Italy and beyond!

Lagarde’s third blunder was her regrettably late reaction to the inflation flare-up, of course, a result of the ECB’s long tradition of disastrous economic forecasts. To be fair, even under Draghi, ECB “analysts” have been systematically wrong when it comes to forecasting recession, inflation, etc. Who can forget their ridiculous forecasts for Greek GDP, debt, etc.?). In fact, throughout Draghi’s presidency of the European Central Bank, the central bank in the eurozone failed miserably to achieve its inflation target (at the level of 2% or slightly less). But the dragon that Draghi failed to slay was not inflation but deflation – negative or very low inflation that forced him to cut interest rates first to zero and then to negative 0.7%.

These negative interest rates made Draghi an object of hatred among Germany’s small-bourgeois savers, especially the “housewife” who was monotonously cited by Angela Merkel as a model of sound financial management. However, most workers in Germany and abroad did not care much because I had only minimal savings while their real (inflation-adjusted) wages were unaffected by the deflation.

This all changed under Lagarde when inflation became positive, and indeed very high. In contrast to deflation, inflation affects the entire population, whether working people or middle-class families struggling to make ends meet. Therefore, the central bank governor who fails to anticipate this will face rejection from all walks of life. We saw this in the 1970s, and we see it now, but this time it’s worse.

In the 1970s, unions were strong enough to offset worker losses caused by inflation, largely through wage increases. Moreover, since women’s participation in the labor market remains low, Popular families were able to maintain their standard of living Thanks to women’s entry into the labor market.

Today, by contrast, unions are a shadow of their former self, and most women are already gainfully employed. Unemployment may be low, but as prices have continued to rise over the past two years, the purchasing power of average working-class families has taken a much worse hit than it did in the 1970s.

In this sense, Draghi was lucky, at least compared to Lagarde. Its tools (most notably the printing of billions to buy eurozone debt) have succeeded under deflationary conditions, at least to the extent that they have succeeded in preventing the bankruptcy of states and companies. The reason Berlin allowed him these tools is that when average prices were falling, the ECB under Draghi was able to pretend that the goal of unlimited money printing was not to save Italy (which ECB law officially prohibits) but to ensure that Prices (which are often negative). ) Interest rates will reach every part of the Eurozone.

Lagarde’s luck ran out early in her term when supply chain bottlenecks caused by the pandemic fueled inflation, which Vladimir Putin later fueled by invading Ukraine and causing the well-known crisis. Nightmarish inflation in energy costs. Lagarde was soon faced with a stark dilemma: keep interest rates below 5%, thus allowing inflation to run away from them, and inadvertently providing arguments and support for the far-right Eurosceptic opposition party, the AfD; Or raise interest rates to levels that would curb inflation but at the same time bankrupt Italy and many European banks and companies? No one was surprised by Lagarde’s choice to delay raising interest rates, a choice that would mathematically lead to strengthening the power of the German far right.

Could Lagarde have done anything differently? As we have been supporting since 2019 Day 25The DiEM25 is pan-European, but mine too PersonallyYes of course he can! He could, for example, have pursued the following dual policy. On the one hand, he quickly raised interest rates to 3% in order to deflate the housing market bubble and not allow inflation to exceed 6% (which later forced him to raise interest rates above 4%). On the other hand, so and To enhance investments (especially in the field of green energy) and to prevent the collapse of the Italian state, to buy (or even announce that it will buy) bonds of the European Investment Bank (with the proceeds going exclusively to finance green technology) and member states. instead of, Lagarde wasted her energy And his political capital in meaningless assessments of the “correctness” of the ESG debt securities that the ECB accepts from banks as collateral (for example, false ESG-type commitments, i.e. “environmental, social and governance”) – is moving, that is. , where They do absolutely nothing To help investment in general and economic transformation in particular.

Moreover, instead of calling for changes to the European treaties that would save the ECB from always having to keep member states solvent (in violation of its statute), Lagarde spent herself Inappropriate speechIn it, she proves that she does not understand the role of the dollar in her planning It is assumed that the dollar will be replaced imminently As a global reserve currency.

And now; Christine Lagarde’s rare combination of incompetence and arrogance has helped revive the political fortunes of the AfD in Germany, Meloni in Italy, and the fascist Vox in Spain, not to mention our own fascists inside and outside the Mitsotakis government (which, unfortunately, are now represented by Our Parliament). All we can do now is hope, in the run-up to the European elections, that the incompetence of the far right will not allow them to take full advantage of Lagarde’s rich gifts.

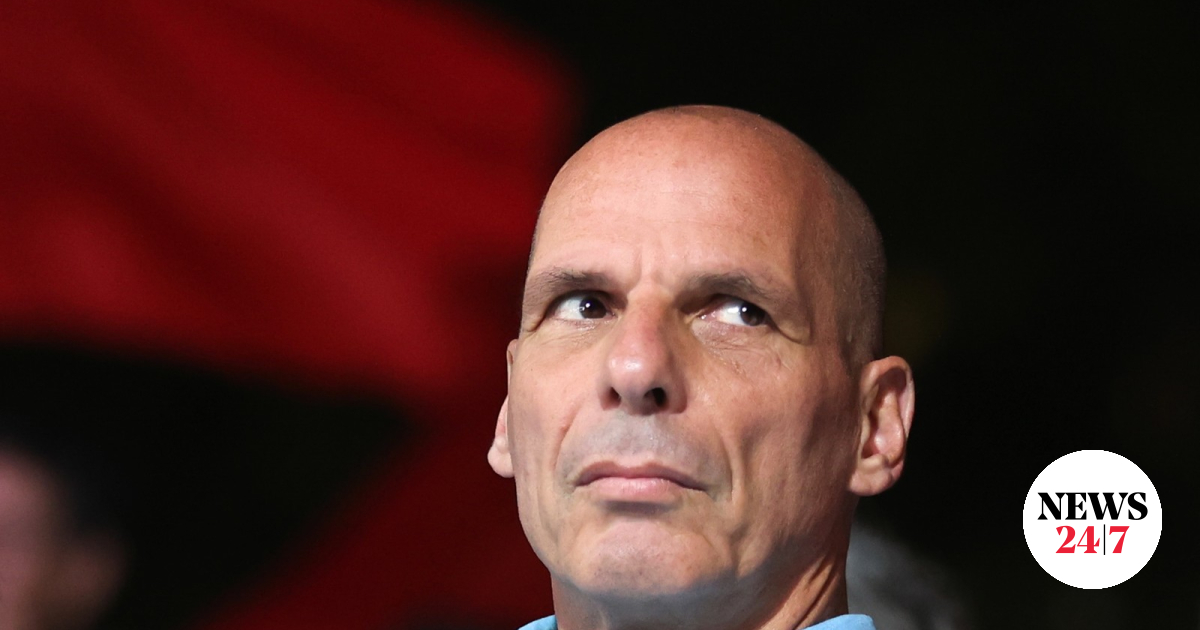

The above article is an exposition Ha Monthly column By Yanis Varoufakis at Project Syndicate

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

Youth Card 2024: More than 145,000 young people will receive €150

Where the largest parking lot in Greece is being built – the new building that will add hundreds of spaces

Theoharis: More than 200,000 companies are linked to IRIS