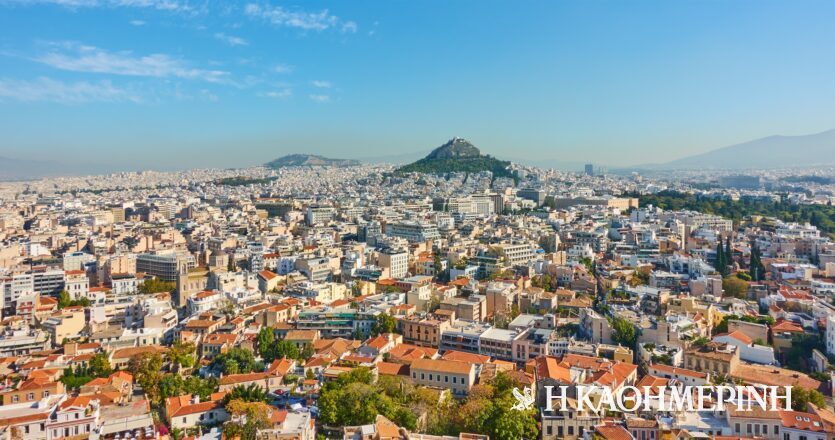

In Athens, the picture is more dynamic, as prices rose during the fourth quarter at an average annual rate of 15.2%, which is also the highest performance in the past decades. intimate photo.

phenomena Price inflation and the constant shrinking of their purchasing power families began to be noticed housing purchase. According to previously published data Bank of Greece (Bank of Greece)During the fourth quarter of 2022, the average increase in residential unit sales prices was 12.2% compared to the corresponding quarter of 2021. Overall apartment prices for the year 2022 witnessed an annual increase of 11.1% compared to an increase of 7.6% in 2021.

In Athens, the picture is more dynamic, as prices rose during the fourth quarter at an average annual rate of 15.2%, which is also the highest performance in the past decades. The increase in Thessaloniki was 14.5%, and in other major cities 10.3%, while the increase in prices in the rest of the country reached 6.3%. Overall, Attica prices in 2022 registered an annual increase of 13%, while the increases in Thessaloniki, the larger cities and the rest of the country were 11.8%, 10% and 7.4%, respectively.

Newly built ones Real estate By 12.1% in the fourth quarter, while 12.2% was an increase in sales prices for old apartments (more than five years). For the whole of 2022, the price increase for newly built homes was 11.8% compared to an increase of 8.2% in 2021. Accordingly, the prices of older apartments increased at an annual rate of 10.5% compared to an increase of 7.2% in 2021.

Eight out of ten home purchases are made without bank financing.

Given that prices started to equal market highs in 2007, but amid an environment of pressure on household incomes, high inflation and the highest cost of money in the last two decades, the real estate market now seems to be running at its paces. Own rules, ignoring the broader macroeconomic environment. The injection of liquidity from the increase in investment interest from abroad is one reason why this is happening.

The other reason relates to the significantly limited supply of real estate for sale, since a large volume, estimated at tens of thousands of homes, is “boxed” for legal or technical reasons, being in the hands of banks and workers.

To date, the largest volume of home purchases is carried out without bank lending (about eight out of ten transactions). This is also the reason why the large and sharp increase in interest rates did not affect demand. However, as prices rise to the €200,000-250,000 level for an average property capable of meeting the needs of a family of four, the more difficult it becomes to cover these amounts exclusively with the same financing. This may “slow down” demand, and have a direct impact on prices.

“Avid problem solver. Extreme social media junkie. Beer buff. Coffee guru. Internet geek. Travel ninja.”

More Stories

Retrospective for retirees: Who is affected, who wins and who loses – Newsbomb – News

With…Rural Sakis Rouvas

The data-altering 'treasure' is coming – where is it?